Term Insurance Premium Calculator

Term Insurance Calculator is an online tool that can help you determine how much life insurance coverage you will need based on your income and savings. You can easily calculate term insurance premiums online and choose the best term insurance plan for yourself.

Term Insurance Premium Calculator helps the policyholder get an estimate of the premium that he/she has to pay monthly/yearly, that too absolutely at no cost. As we know, many term insurance companies in India offer life insurance plans. A term insurance calculator can be extremely helpful when you are going to buy a term insurance plan in India.

A term plan premium calculator is an easy-to-use online tool that allows customers to customize the premium according to their convenience and financial suitability. Read below to get a detailed understanding of the Term Plan Calculator.

How Does Term Insurance Premium Calculator Work?

A term insurance premium calculator is a tool that helps individuals estimate the premium amount to be paid for a term life insurance policy. Term insurance calculator uses specific algorithms and formulas to calculate the premium based on the information provided by the user. Here's how a term insurance premium calculator typically works:

Input Parameters

The term plan premium calculator requires users to input certain parameters that affect the premium calculation. These parameters typically include:

- Age: The policyholder's age is crucial in determining the premium. Generally, younger individuals pay lower premiums compared to older individuals.

- Sum Assured: The desired coverage amount or sum assured is the payment that the policyholder's beneficiaries will receive in the event of the policyholder's death. The amount of coverage affects the premium and a higher coverage amount results in a higher premium.

- Policy Term: The duration of the term insurance policy, also known as the policy term, affects the premium calculation. Longer policy terms often lead to higher premiums.

- Smoker/Non-smoker Status: Life Insurance companies consider smoking a risk factor. Smokers are generally charged higher premiums than non-smokers due to the associated health risks.

- Medical History: The term plan premium calculator may ask for information about the policyholder's medical history, such as pre-existing medical conditions or any past surgeries. This information helps insurers assess the risk profile and determine the premium.

- Occupation: Some term plan calculators may consider the policyholder's occupation as a factor in premium calculation, as certain professions may involve higher risks.

Calculation Methodology

Once the required parameters are input, the term plan calculator uses a predefined algorithm or formula to calculate the premium amount. The algorithm considers the specific risk factors associated with the individual and the desired coverage amount.

Premium Calculation Results

The Term insurance plan calculator estimates the premium amount based on the input parameters. The design of the term calculator can display the premium as an annual, half-yearly, quarterly or monthly amount.

Comparison and Customization

Some term insurance premium calculators can modify the input parameters to compare premiums for different scenarios. Users can adjust factors such as sum assured, policy term, or smoker/non-smoker status to see how these changes affect the premium amount. This allows users to customize their coverage and explore different options that align with their budget and coverage needs.

Using a Term Insurance Premium Calculator can help individuals get a preliminary understanding of the premium amounts associated with term life insurance policies. However, for accurate and personalized premium quotes, contacting the insurance company or RenewBuy’s Partners is recommended, who can consider additional factors and provide more precise premium calculations based on individual circumstances.

Types of Term Insurance Calculators

Various term insurance calculators are available to help individuals estimate their premium amounts and make informed decisions about their term life insurance policies. Here are some common types of term insurance calculators:

-

Input Parameters

The term plan premium calculator requires users to input certain parameters that affect the premium calculation. These parameters typically include:

-

Basic Term Insurance Premium Calculator

This type of calculator is the most common and widely available. It allows users to enter basic information like age, sum insured, policy term and smoker/non-smoker status to calculate the estimated premium amount. Basic calculators provide a quick and straightforward way to get an initial premium estimate.

-

Advanced Term Insurance Premium Calculator

Advanced calculators provide more detailed and comprehensive premium calculations. They consider additional factors such as medical history, occupation and lifestyle choices to provide a more accurate premium estimate. These calculators consider a wide range of variables for more personalized premium calculations.

-

Riders and Add-ons Calculators

Some calculators focus specifically on riders and add-ons that can be added to a term life insurance policy. These calculators allow users to determine the impact of adding optional riders like critical illness cover or accidental death benefit on the overall premium amount. Users can adjust rider options and coverage amounts to understand how these affect additional premiums.

-

Comparison Calculators

Comparison calculators are designed to help users compare premium quotes from multiple insurance providers. These calculators allow users to enter their information once and get premium estimates from different insurers. Users can compare the coverage, premium amount and features offered by different insurers to make an informed decision about their term life insurance policy.

-

Convertible Term Insurance Calculator

Convertible term insurance calculators focus on policies that offer conversion options. These calculators help users understand how the premium may change if they later choose to convert their term insurance policy to a permanent life insurance policy. They allow users to evaluate the potential cost implications of a conversion and make decisions accordingly.

-

Income Replacement Calculator

Income replacement calculators are designed to help individuals determine the coverage amount needed to replace their income in the event of death. These calculators consider factors such as current income, future income growth and the number of years the income needs to be replaced. They provide an estimate of the coverage amount needed for adequate income replacement.

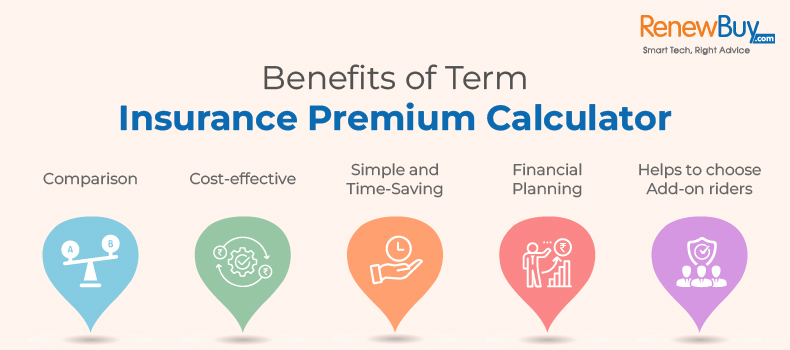

Benefits of Term Insurance Premium Calculator

A term insurance calculator will help you compare different plans to find the one that suits all your needs. Apart from this, the term insurance calculator offers many other benefits to the policyholders. Given below is the list of benefits of a term insurance premium calculator which will help you understand the importance of a term plan calculator in the present age:

Comparison

Term Insurance Calculator lets you compare different term insurance policies at the same time. It will also help you find out the premium for various term insurance policies. Term Plan Premium Calculator will help you find and buy the best term insurance policy as per your needs.

Cost-effective

Term Insurance Premium Calculator is a free online tool. You can compare and calculate premiums of different term insurance plans without paying any amount.

Simple and Time-Saving

The term plan calculator helps you to save time as you do not need to submit any hard copies of documents. All you need to do is enter your details and requirements to get premium quotes. Term Insurance Premium Calculator will take a few minutes to show you the best term plan to suit your stated needs. Once you are sure about the plan, you can buy it online without any hassle.

Financial Planning

Term Insurance Calculator also helps in financial planning by estimating the amount of premium to be paid by you. Once you know how much you will have to pay in premiums, you can manage your budget appropriately.

Helps to choose Add-on riders

Term insurance plans offer various additional riders that enhance the term insurance coverage. Term plan premium calculator helps to select add-on-riders while calculating the premium amount. You can check the best possible premium offered by the term insurance company after adding additional riders through the term insurance premium calculator.

How to Use Term Life Insurance Calculator?

Using a term life insurance calculator can help you estimate the coverage amount and premium for a term life insurance policy. Here's a step-by-step guide on how to use a term life insurance calculator:

-

Find a Reliable Calculator

Many life insurance companies offer online term plan calculators on their websites. Look for a reputable life insurance company with a term life insurance calculator.

-

Enter your Basic Information

Enter your basic details, such as your age, gender, and smoking status. These factors can affect the premium amount.

-

Input coverage details

Enter the desired policy term and the coverage amount you want in your life insurance policy.

-

Provide additional information

Some Term life insurance calculators may require additional information, such as your height, weight, occupation, and medical history. This information helps the calculator provide a more accurate estimate.

-

Review the results

Once you've entered all the necessary information, the term insurance plan calculator will estimate the premium amount for the specified coverage. It may also display other policy details, such as the sum assured or death benefit.

-

Adjust as needed

If the premium estimate exceeds your budget, you can adjust the coverage amount or term to see how it affects the premium. The term insurance plan calculator allows you to experiment with different scenarios until you find a suitable balance.

-

Compare options

If you're considering multiple insurance companies, use their term insurance plan calculators to compare premiums and coverage. This will help you decide based on your requirements and budget.

-

Consult an insurance professional

While the term insurance plan calculator provides a useful estimate, we recommend consulting our RenewBuy’s partner for personalized advice. They can help you understand the intricacies of the policy, answer any questions you may have, and assist you in selecting the most suitable term life insurance plan.

Common Mistakes To Avoid When Using Term Insurance Premium Calculator

When using term insurance premium calculators, it is important to be mindful of potential mistakes that may affect the accuracy of premium estimates or lead to misinterpretation of the results. Here are some common mistakes to avoid when using a term insurance premium calculator:

Inputting Incorrect Information

Make sure you enter accurate and up-to-date information into the calculator. Small errors or inaccuracies in age, sum assured, policy term, or other factors can cause significant differences in the premium estimate. Double-check the information you provided to term plan premium calculator to ensure its accuracy.

Neglecting to Consider Riders and Add-ons

Remember to include riders or coverages in your term insurance policy if you plan to include them in the calculator. Not taking into account riders or add-ons while using the term insurance plan calculator can lead to inaccurate premium estimates. Include all relevant options and adjust the coverage amount accordingly.

Failing to Account for Underwriting

Term insurance premium calculators provide estimates based on general assumptions. However, the underwriting process can affect the actual premium, which includes a detailed assessment of your health, lifestyle, occupation and other factors. Understand that underwriting considerations may vary from the calculator's estimate in the final premium.

Not Comparing Quotes

While a term insurance premium calculator can provide an estimate, comparing quotes from multiple insurance providers is essential. Different insurers may offer different premium rates for the same coverage. Use term plan calculator to get a preliminary estimate, but also reach out to insurers or agents for personalized quotes based on your specific circumstances.

Overlooking Policy Specifics and Conditions

Remember that the term insurance premium calculator provides a general estimate and does not consider each policy's specific terms or features. Read the policy terms and conditions carefully to fully understand the coverage, exclusions, limitations and other important details that may affect your premium and overall policy suitability.

Relying Solely on the Calculator

Although the term insurance premium calculator is useful, it should not be the sole basis for making insurance decisions. Consider consulting with insurance professionals or advisors who can provide personalized guidance based on your specific needs and circumstances. They can help you understand the nuances of different policies and ensure that you make well-informed choices.

Not Reviewing Your Term Plan Regularly

Reviewing your term insurance needs and revisiting the calculator occasionally is important. Factors such as changes in income, lifestyle or family situation may affect your coverage needs. Re-evaluate your term insurance needs regularly and use the term insurance plan calculator to adjust your coverage and premium estimates accordingly.

By avoiding these common mistakes, you can use a term insurance premium calculator more effectively and get a more accurate premium estimate. Remember that the term plan calculator results are indicative and should be complemented with thorough research and professional advice.

What Happens if You Don’t Use Term Plan Calculator?

Using a term insurance plan calculator is quite useful and time-saving when comparing different policies and customizing them per your insurance requirements and financial suitability. Not using the term plan calculator, may lead you to face the following consequences:

Inadequate Coverage

Without calculating the adequate coverage needs, the customers might end up with a term life policy that doesn't provide enough coverage for their dependents in case of their untimely demise.

Overpaying

Without using the term plan premium calculator, customers won’t be aware of the different benefits and coverages they can avail of at an affordable price. On overestimating their coverage needs, they may end up paying comparatively higher premiums for coverage they don't actually require.

Missed Opportunities

By not using a term plan calculator, the customer might miss out on exploring different coverage options and riders that could better suit their specific needs, such as critical illness riders or accidental death benefits, etc.

Difficulty in Comparison

Using a term insurance premium calculator, customers can more effectively compare different policies based on their specific needs and budget.

Term Insurance Plan Calculator - Understand the Importance With An Example

Let’s understand the usage of the term plan calculator with two practical examples:

Scenario 1: Raj's Experience with a Term Plan Calculator

Raj, a 30-year-old software engineer living in Bangalore, decides it's time to secure his family's financial future by purchasing a term life insurance policy. He uses a term insurance plan calculator to calculate adequate coverage.

After inputting his annual income, outstanding loans, household expenses, and future financial goals, the term insurance plan calculator recommends a coverage amount of ₹1 crore for a 25-year term.

This amount would ensure that his family can maintain their lifestyle, repay outstanding debts, and cover his children's education expenses even if he's no longer there to provide for them.

Scenario 2: Rohan’s Experience Without a Term Plan Calculator

Rohan, a 35-year-old marketing manager based in Mumbai, decides to purchase a term life insurance policy after realizing the importance of financial security for her family. However, he doesn't use a term insurance plan calculator and instead relies on a rough estimate of his coverage needs.

Without a clear understanding of his financial obligations and future expenses, Rohan selected a life-term policy with a coverage amount of ₹50 lakhs for a 20-year term, simply because it seemed like a reasonable amount at the time.

He also opts for additional riders without fully understanding their implications or whether they're necessary for her situation.

Over the years, his family has experienced significant changes, including a new home loan, higher education expenses for her children, and increased household expenses.

However, his insurance coverage remains the same, leaving her family potentially underinsured if something were to happen to him. If he had used the term plan premium calculator, he could save his family from the financial hardship that occurred in his absence.

How to calculate premium from RenewBuy Term Insurance Calculator?

Generally, every term insurance company provides a term life insurance calculator, where you can calculate the estimated premium for your term insurance policy. But "RenewBuy" has introduced its Term Life Insurance Premium Calculator with a simple and hassle-free process. Below are the steps to calculate the premium for term insurance using the “RenewBuy” term insurance calculator.

- Visit the official website of “RenewBuy”.

- Scroll down and click on the “life” term insurance calculator.

- Enter the asked details such as DOB, Gender, Tobacco consumption, Annual salary, Get insured till (age), and sum assured.

- Click on “Get Instant Quotes”

- The next page will display the “best term insurance plans” as per your requirements.

Factors that Determine Term Insurance Premium

As we discussed above the process of calculating the term insurance premium via a term insurance calculator. The term insurance premium depends upon various factors. It is important for you to know the factors that can impact your term insurance premium amount:

Age

Age is one of the most important factors that affect the premium amount. In simple words, the premium amount of term insurance also increases with age as older people are more prone to get infected with diseases. Hence, it is advisable to buy a term plan at an early age to avoid the high premium amount.

Gender

As per various health studies, women live more than men. Therefore, term insurance companies charge a lesser premium to women as compared to men.

Body Mass Index (BMI)

BMI is a measure of body fatness. High BMI can cause many health problems. People with high BMI are at risk of heart disease, diabetes, obesity, etc. A person with a higher BMI has to pay a high premium amount.

Pre-existing disease

Pre-existing diseases need additional coverage. Individuals with a pre-existing disease have to pay a higher premium amount for a term insurance policy.

Sum Assured

The sum assured you choose also affects the premium you pay. It is essential to choose the sum assured keeping in mind your financial goals and inflation rate. The sum assured that is sufficient for your family may not be enough in the future, so choose the sum assured amount keeping all these factors in mind.

Lifestyle

Your current lifestyle has a significant impact on the term insurance premium calculation. Your current expenses, annual income, liabilities, debts, and the financial expenses of your dependents impact your term insurance premium amount. For example: If you like to take part in adventure activities like mountaineering, skydiving or sea diving, etc., then the term insurance company will charge a higher premium amount.

Personal Habits

The personal habits of an individual impact the term insurance premium. Suppose, if someone has smoking habits or is an alcoholic, he/she will be more prone to life-threatening diseases and will have to pay high premiums amount.

Occupation

Your profession also affects the amount of premium you pay. If you work in jobs that are considered hazardous, you may have to pay a high premium amount to buy a term insurance plan. The term insurance premium calculator also considers other factors, so it depends on the plan you choose.

How to Pay Your Term Insurance Premium?

Term insurance companies offer various premium payment options to customers. Customers can pay their term insurance premium in two ways: Online mode and Offline mode. Both premium payment processes are explained below:

Online mode

- Credit Card

- Debit Card

- Net Banking

- UPI

- Payment Wallet

- ECS

Offline mode

Customers can also pay their term insurance premium in a cash payment by visiting the nearest branch of the term insurance company.

Is Online Term Insurance Calculator Reliable?

Term Insurance Calculator saves time and energy by eliminating the hassle of lengthy manual calculations. It also removes human errors. To get an accurate estimate of your term insurance premium, you need to enter accurate personal information, the desired sum assured, and the preferred policy term to calculate the premium amount for various term insurance plans. Term Insurance Premium Calculator provides accurate results of term insurance premiums offered by various term insurance companies. It also helps you choose your term plan smartly and wisely as it shows various term insurance plans that are best for you as per your needs.